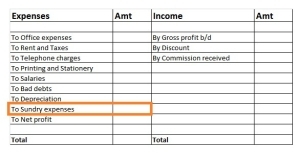

The group then subtracts the COGS from web revenue to search out the gross margin. Basic expenses are the prices a enterprise incurs as a half of its day by day operations, separate from promoting and administration bills. Examples of common expenses embody rent, utilities, postage, supplies and pc tools.

Gross Revenue Vs Web Income: What’s The Difference?

They must be recorded in your company’s revenue assertion, and are taxable similar to other forms of expenses¹. Sundry income is a nonmaterial source of earnings and is usually trivial in relation to a company’s earnings from operations. Even though sundry revenue might not make up a big a half of a business’s income, this doesn’t mean the amounts are negligible. As talked about above these types of bills https://www.kelleysbookkeeping.com/ do not usually have a separate ledger account nonetheless they are often grouped together and clubbed collectively as sundry expenses.

- Businesses can simply create sundry invoices utilizing predefined templates and ship them electronically to clients.

- Working income seems at profit after deducting operating bills similar to wages, depreciation, and cost of goods bought.

- Grouping sundry expenses can provide higher visibility into overall cash requirements.

- Sundry accounts permit businesses to categorize small, irregular items without overcomplicating their books.

Presentation Of Sundry Expenses

This invoice retains issues simple and to the purpose, which is ideal for minor, one-off costs like printing fees. When creditors are categorized, you can rapidly determine patterns, allocate budgets effectively, and be sure that all money owed – big or small – are accounted for. Failure to issue proper invoices can result in disputes with customers or suppliers and should violate shopper protection legal guidelines or tax laws. One example is subscription fees for services or merchandise that are not part of the core enterprise offerings. These subscriptions could additionally be for software instruments, publications, or memberships that the enterprise occasionally purchases.

Q2: Why Is It Important To Track Sundry Expenses?

Categorizing creditors ensures that you can simply observe how a lot cash your small business owes and to whom. For small businesses, this is important to keep away from missing payments and maintain good relationships with suppliers. In this guide, we’ll cover the purpose of sundry invoices, how they differ from common invoices, and provide a step-by-step guide for creating one. In the money move statement, sundry income have to be categorized correctly—often underneath “investing activities” or “financing activities,” relying on its source. Accurate classification is crucial for providing a complete view of how these income streams have an effect on liquidity and operational cash move.

Correct classification in financial information is essential for compliance and tax optimization. Companies often encounter varied types of earnings beyond their major operations, and varied income is one such class. This sort of revenue arises from unexpected or irregular sources, making it a vital aspect for firms to acknowledge and manage successfully. Understanding how sundry income functions inside a business’s monetary framework is crucial for correct reporting and strategic planning. This income ought to be moved out of the sundries account and into a new account for international returns as a outcome of the events happen frequently. Postage, workplace supplies and stationery, minor repairs and maintenance, telecommunications payments, and may embody other bills.

For the previous 52 years, Harold Averkamp (CPA, MBA) has labored as an accounting supervisor, manager, advisor, university teacher, and innovator in instructing accounting on-line. Chip Stapleton is a Sequence 7 and Sequence 66 license holder, CFA Level 1 exam holder, and currently holds a Life, Accident, and Health License in Indiana. He has eight years experience in finance, from financial planning and wealth management to company finance and FP&A. With our tremendous software program and talented group of qualified accountants, taking care of your small business sundry definition accounting admin has never been simpler. Shaun Conrad is a Licensed Public Accountant and CPA examination professional with a ardour for educating.